Loans Management Software User Guide

- Home

- User Guide

Loans

This feature allows you to keep track of all your loan details in one place.

1. Loans

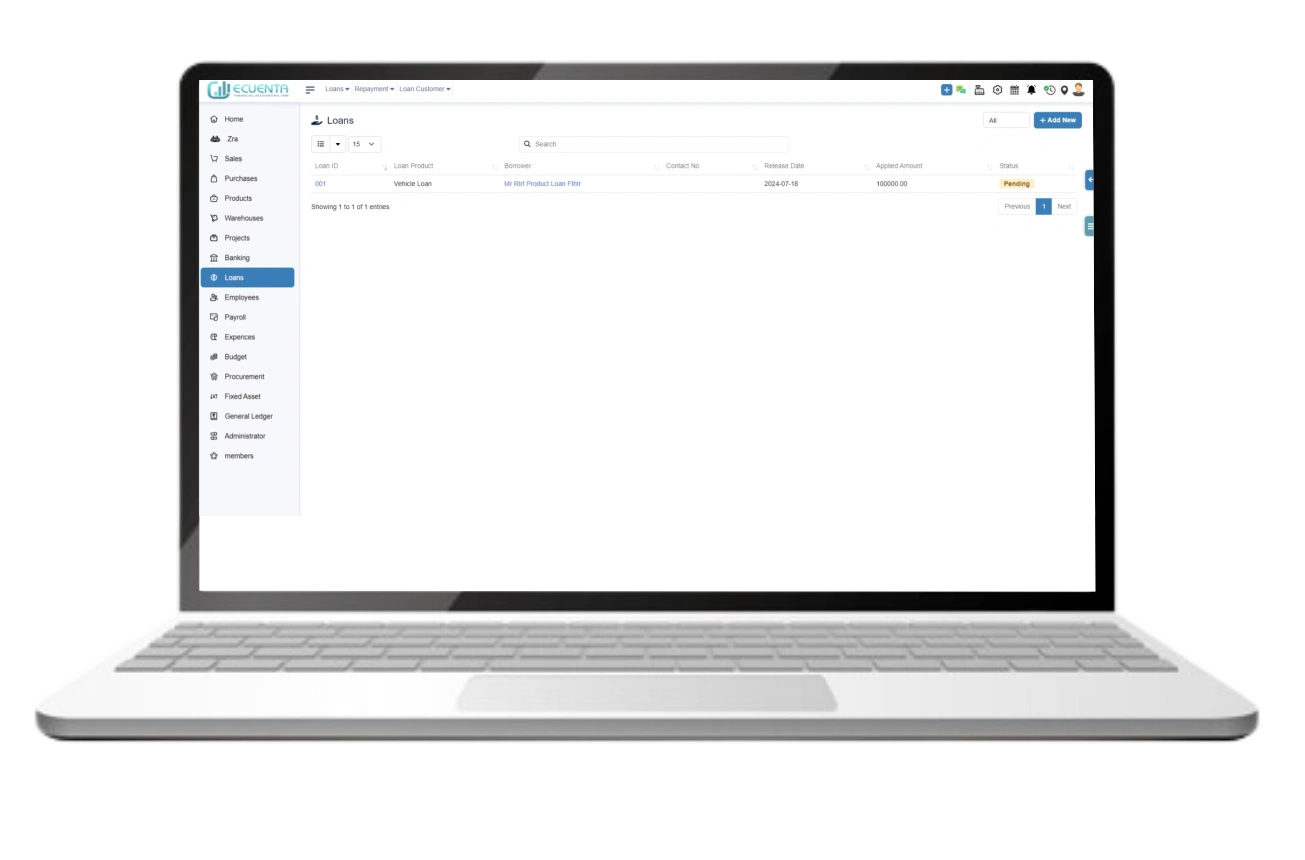

1.1 All Loans

By Clicking all Loans, you will see a table that displays a list of all the loan details such as Loan ID, Loan Product, Borrower, Release Date, Applied Amount, and Status.

You can use the filter options to view approved, completed, or pending loans. To see all loan details, select 'All' from the filter options.

To add a new loan entry, click on the 'Add New' button. You will be taken to a form where you can enter the loan details, then click the create button.

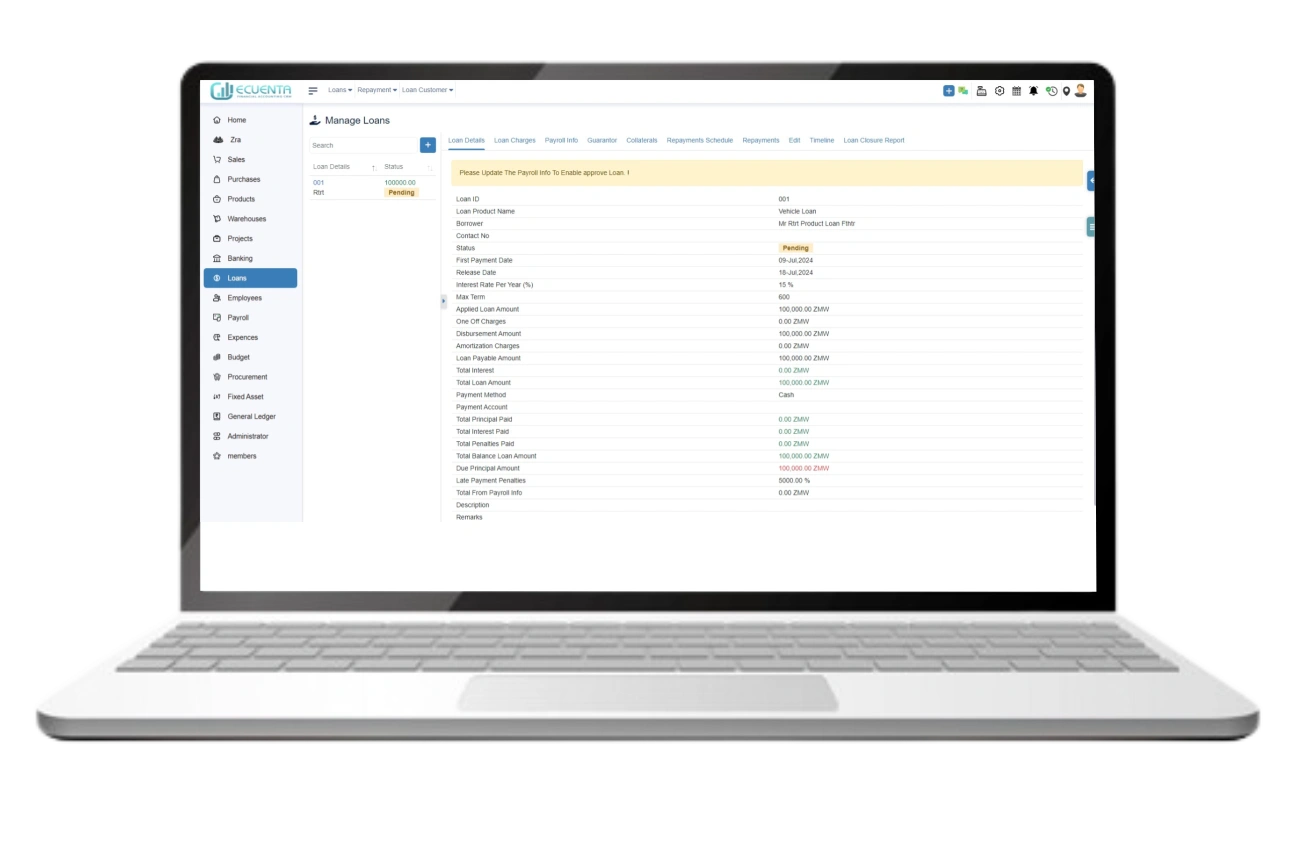

To view loan details, click on a loan ID you are interested in.

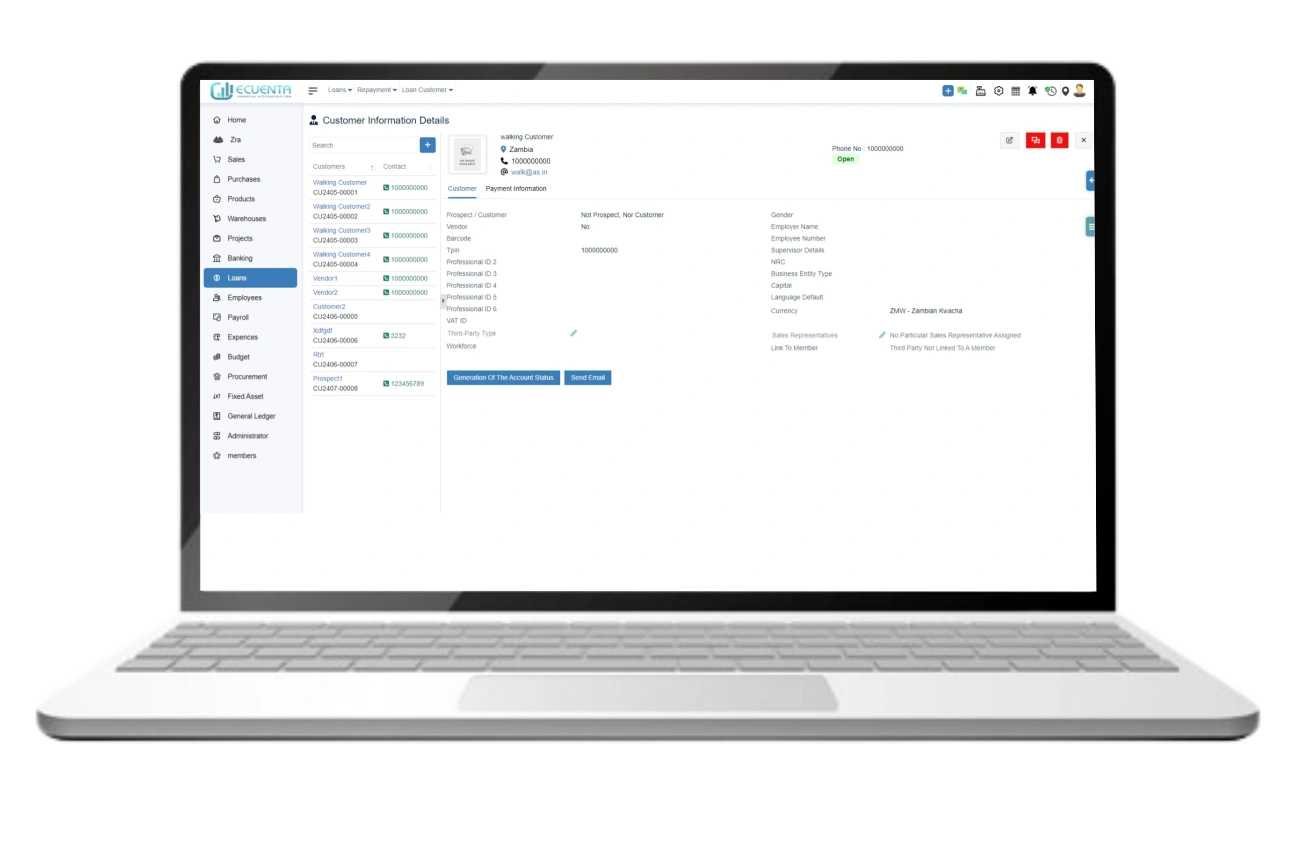

If you want to view borrower details, click on their name.

It allows you to effortlessly access, modify, and remove customer details.

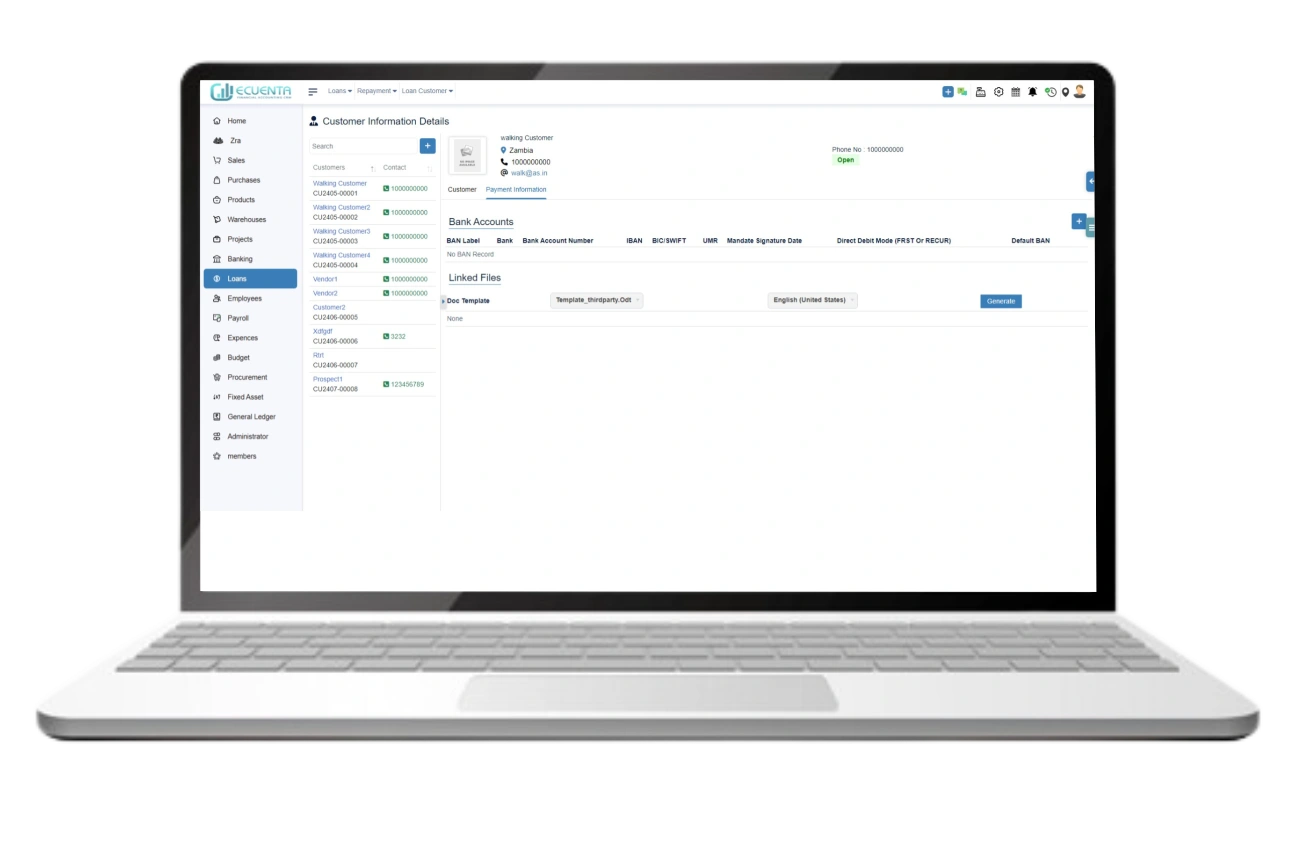

By clicking payment information, it allows you to access the bank accounts and linked files.

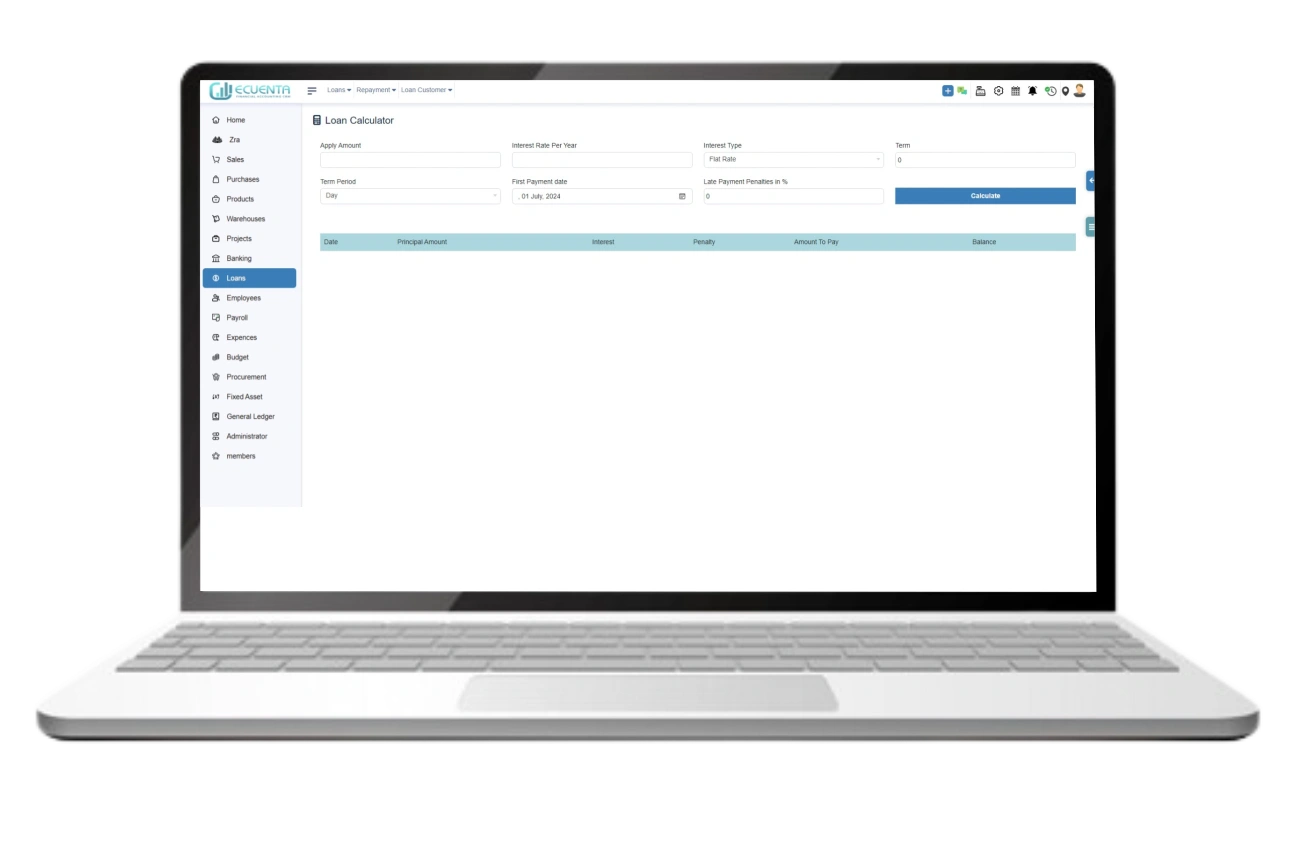

1.2 Loan Calculator

Clicking Loan Calculator allows you to calculate the Loan by filling out the form with the following information: Apply Amount, Interest Rate Per Year, Interest Type (select one of the available options), Term, Term Period (select one of the available options), First Payment Date, and Late Payment Penalties in %.

Click the Calculate button.

A table will be generated with the following information: Date, Principal Amount, Interest, Penalty Amount, Amount to Pay, and Balance. the Loan Calculator can help you calculate the necessary payments and stay on track with your loan.

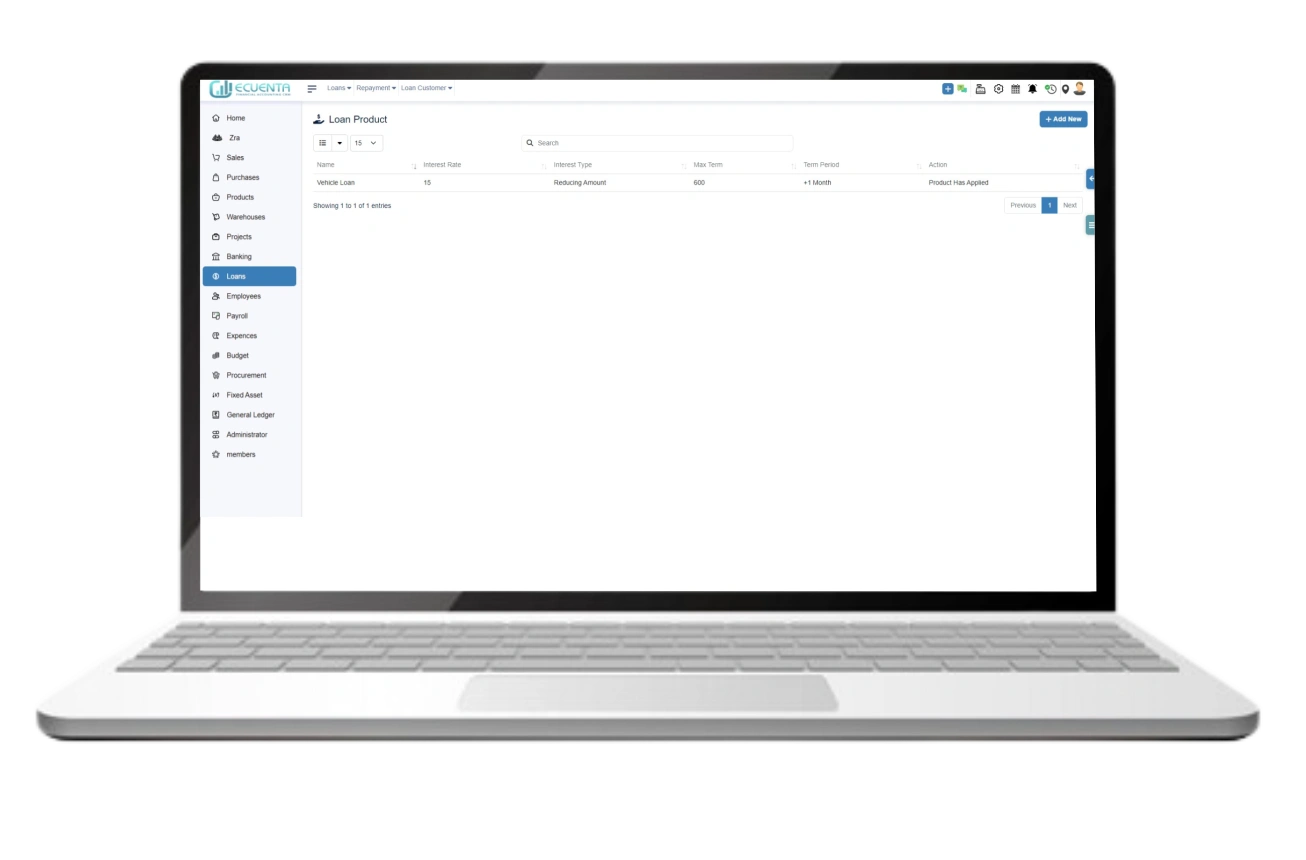

1.3 Loan Product

By clicking Loan Product, you can view the details of various loan products and also add new products to the list.

All the loan product details are displayed in a tabular format. The table includes the name of the product, interest rate, interest type, maximum term, term period, and action.

To add a new loan product, click on the "Add New" button. This will take you to a New Loan Product form where you can enter all the details of the new product. Once you have entered all the details, click on the "Create new loan product" button to add the product to the list.

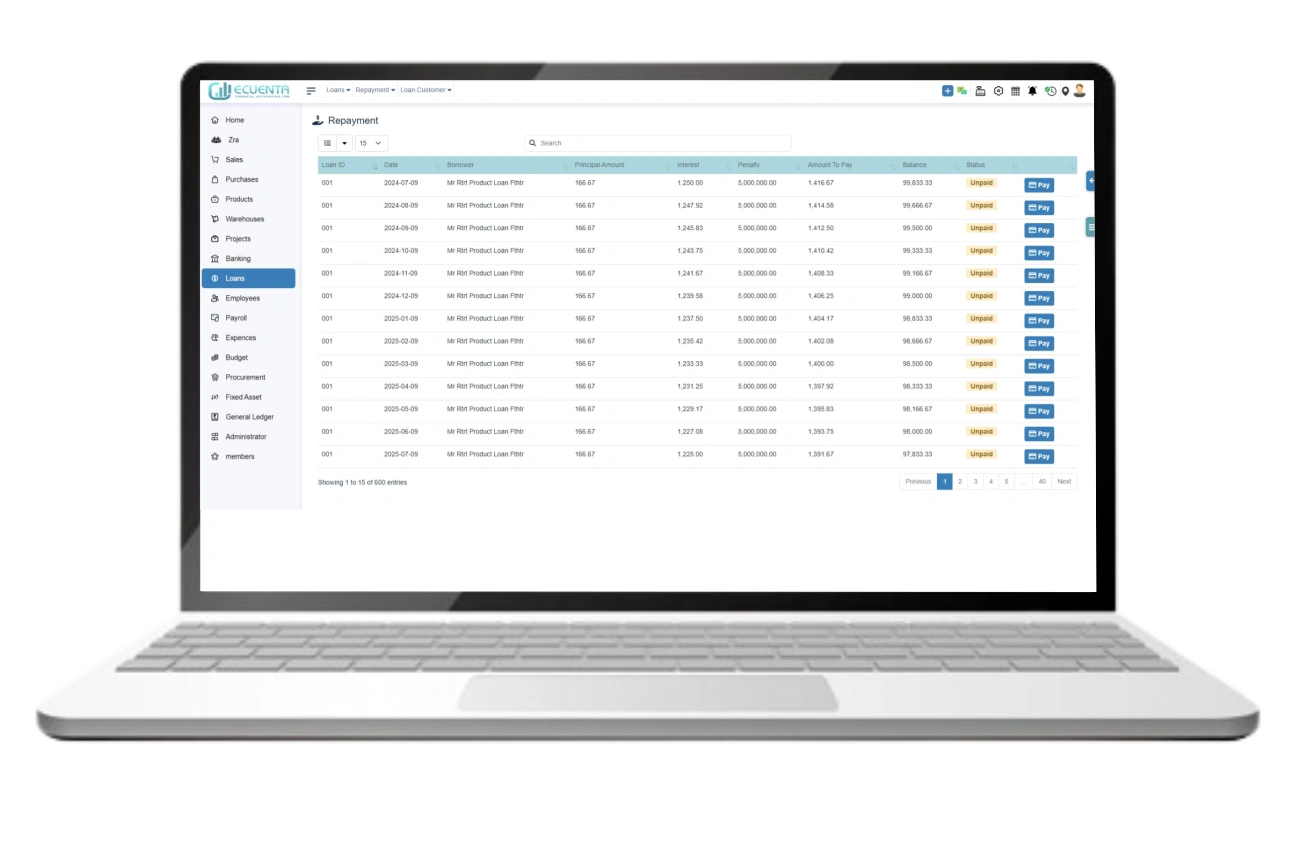

2. Repayment

By clicking Repayment, it shows a list of all loan repayments allowing you to keep track of them easily and efficiently.

The repayment table displays details for each repayment, including loan ID, date, principal amount, interest, penalty, amount to pay, balance, and status(paid, unpaid, due).

To make a payment, click on the "Pay" button in the repayment table you wish to pay. This will direct you to the payment page.

On the payment page, fill in the details and click the make payment button.

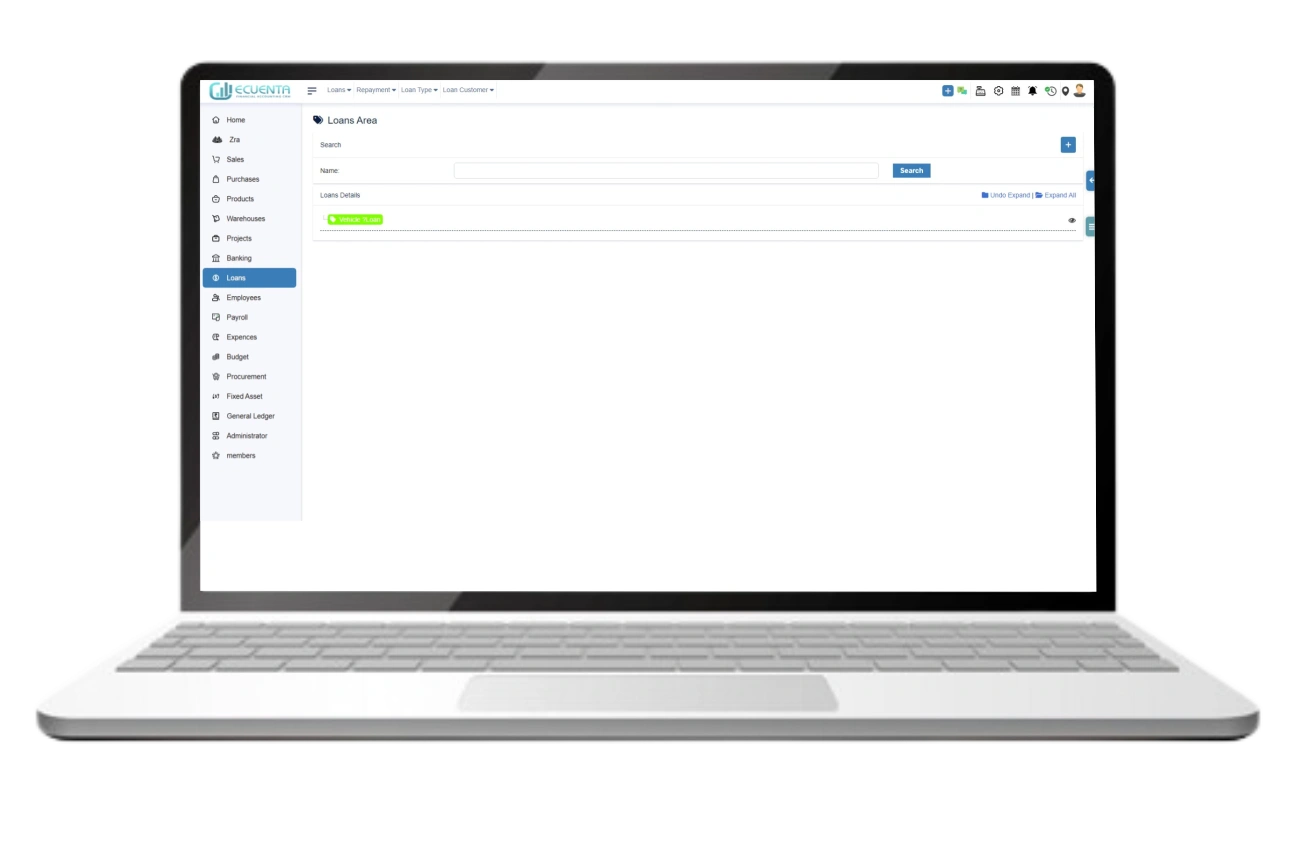

3. Loan Type

Clicking Loan type, allows you to view a list of categorized and tagged loan types that you have already created.

If you want to create a new loan type, click on the button and fill out the form with the following fields: Ref, Description, Color (choose the color), and Add-in choose which category the loan type belongs to, then click create Loan.

-

Ecuenta is the first ZRA-certified and ZRA-integrated accounting software in Zambia. Our comprehensive service offers streamlined accounting solutions tailored for businesses operating across India, Zambia, UK and the USA.

Quick Links

Main Links

Support

- 9b Ngwezi road, Roma, Lusaka, Zambia

- info@ecuenta.online

- +260-764 864 419