At Ecuenta, we take great pride in ourZRA certification! Yes, We Are Certified by "Zambian Revenue Authority"

Taxation is easy with Ecuenta ZRA Smart Invoice System

The digital transformation of tax systems worldwide has now reached Zambia with the introduction of the Smart Invoice system. The Zambian Revenue Authority (ZRA) has announced that effective July 1, 2024, all VAT-registered taxpayers must issue e-invoices using the Smart Invoice software solution implemented by ZRA.

Ecuenta has been audited and certified by the Zambian Revenue Authority (ZRA) in 2021. We assure you of a hassle-free integration process. The Ecuenta Smart Invoice system allows for easy customization to fit your specific needs. With the support of the Voxforem Development team, integrating your business with the Smart Invoice system is seamless. You can incorporate the Ecuenta Smart Invoice (e-invoicing) system on your desktops and laptops, enabling users to create, customize, and manage transactions locally on their own devices. Taxpayers with invoicing needs can integrate with Ecuenta Smart Invoice accounting software. Each Smart Invoice will generate a QR code that can be scanned with any mobile device for verification.

Most Comprehensive Accounting Software for All Your Smart Invoice Needs

Voxforem is the pioneering development company behind Ecuenta, a ZRA-integrated software certified by the Zambia Revenue Authority. Our expertise began with the first version of ZRA, and we have consistently updated our software to align with the latest ZRA regulations.

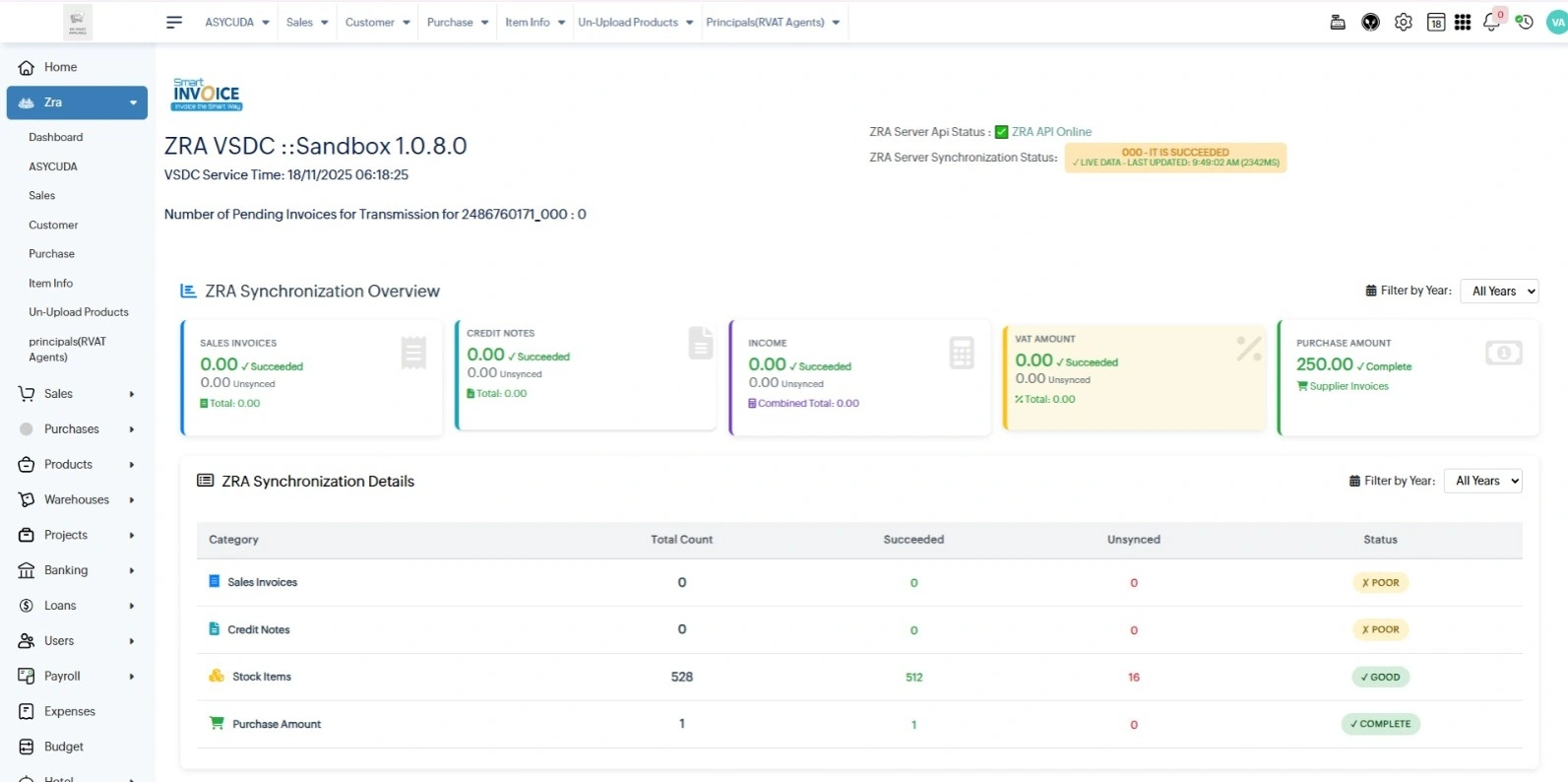

Many clients rely on our Ecuenta accounting software, which is fully compatible with ZRA tax regulations. Once installed, Ecuenta seamlessly synchronizes data with the Smart Invoice system, allowing you to easily verify the accuracy of your synchronized data through both Ecuenta and the ZRA portal. Ecuenta enables the generation of single-page invoice, detailed invoice and POS invoice all of which are directly registered with the Smart Invoice portal, complete with reference numbers.

Our extensive experience with ZRA development began when ZRA was first introduced, and we continue to adapt our software to meet the latest regulatory updates. As ZRA tax regulations are mandatory for all businesses in Zambia, and with global trends moving towards similar compliance, the importance of integrated accounting software cannot be overstated.

Contact us now for advanced ZRA-integrated accounting software to ensure your business stays compliant and efficient.

WE HANDLE THE ENTIRE PROCESS FOR YOU!

To use the Ecuenta ZRA Smart Invoice system, follow these steps

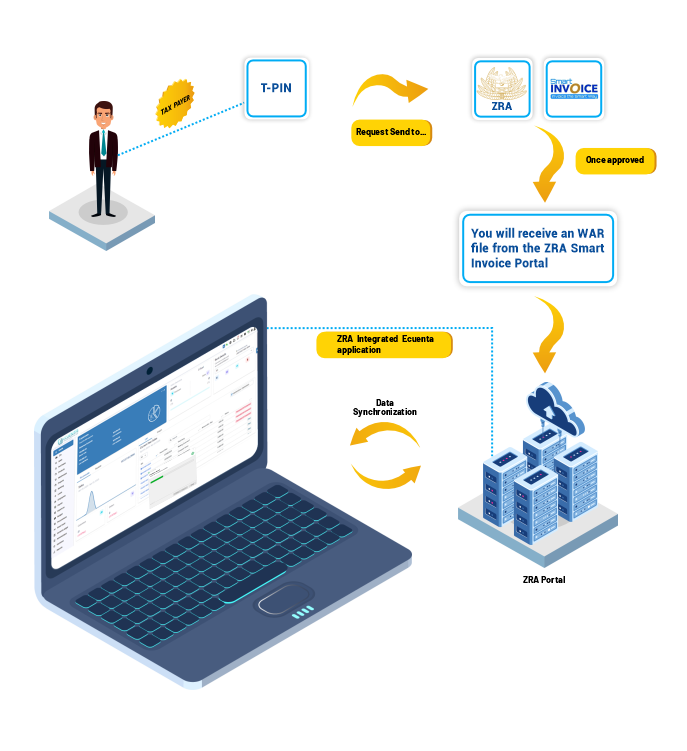

Register TPIN: Register your TPIN with the ZRA sandbox, and apply for Smart Invoice.

Approval: Once you receive approval from the ZRA portal, log in with your credentials.

TPIN and Branch Code Registration: After registering your TPIN and Branch Code, download the dedicated WAR file from the Smart Invoice portal and configure it with the Ecuenta application.

Configuration: Once configured, check the status of the ZRA configuration through the Ecuenta application.

Data Synchronization: After completing all configuration processes, the same data will appear in both the Ecuenta software and the Smart Invoice portal. You can check your invoices through either platform.

Management: With Ecuenta software, you can manage item management, stock management, transaction management, tax annexure sales invoicing, and much more.

Deploy Ecuenta Software to Streamline the Entire ZRA Smart Invoice Process

-

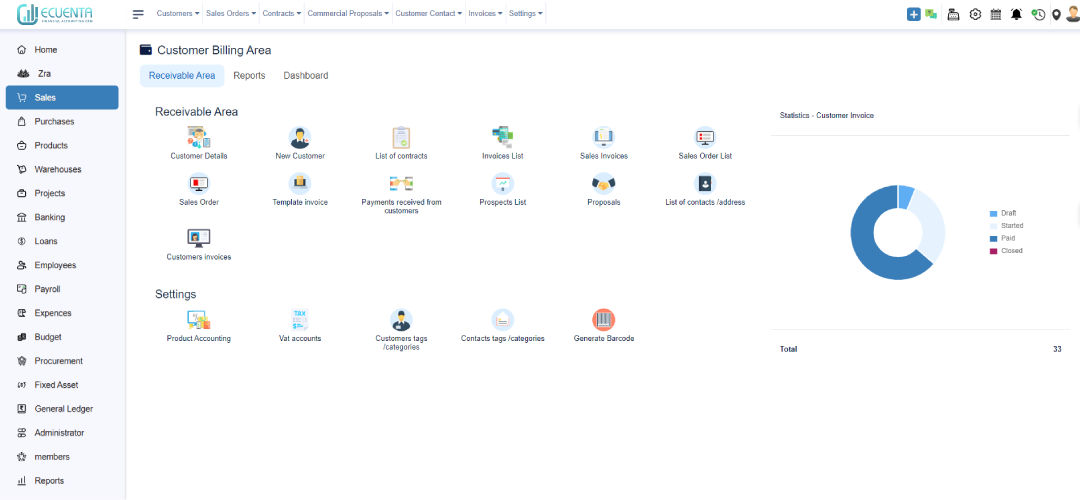

Sales

- This sales functionality allows you to create customers, sales orders, contracts, proposals, and customer contracts.

- Each sales invoice includes the ZRA invoice status, ZRA receipt number, and a unique QR code. Each invoice is assigned a separate QR code.

- Once the sales invoice is completed, the data will automatically sync with Ecuenta and the Smart Invoice Portal.

-

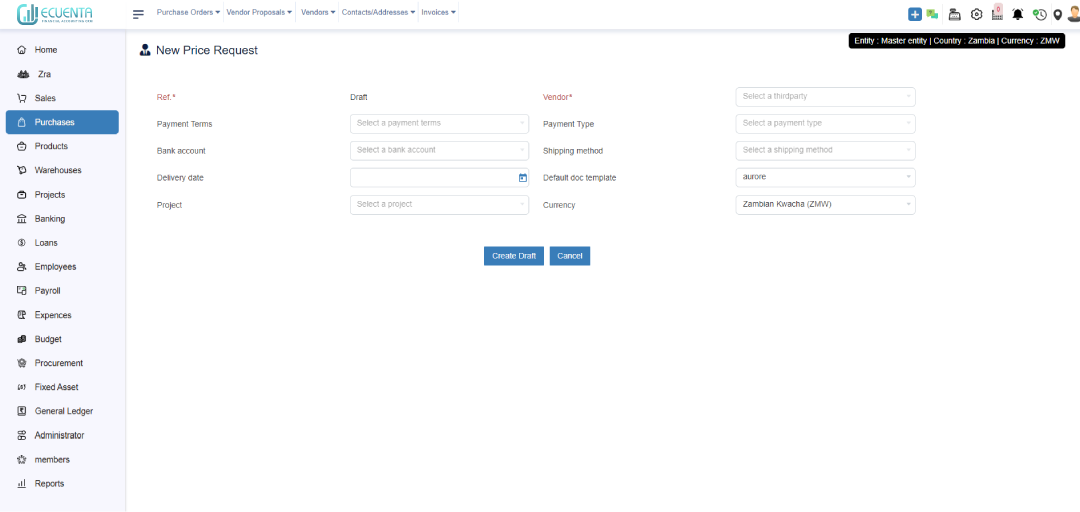

Purchase

- Before creating a new purchase order, you must first create vendor details, including mandatory fields such as T-PIN and branch code.

- Once the vendor is created, you can proceed to create a new purchase order.

- After the purchase order is created, the order will automatically sync with Ecuenta and the Smart Invoice Portal.

-

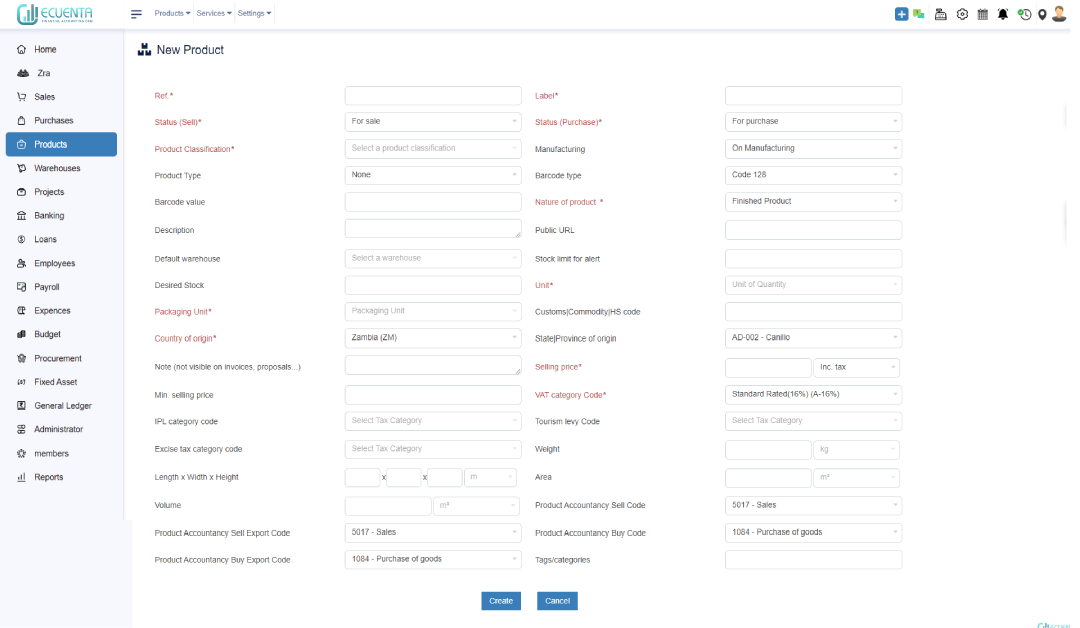

Product

- When adding a new product to the product list, you need to provide information such as product classification, nature, unit, selling price, VAT category code, IPL category code, Tourism Levy Code, Excise Tax Category Code, and other relevant fields. These fields will be directly updated from the ZRA portal.

- Once you have successfully added a product, a success message will appear with the newly generated product code. This information is directly retrieved from the ZRA portal.

- After successfully adding a product, the product details automatically sync with both the Ecuenta and Smart Invoice portals. You can check the product details through either portal.