User Guide

- Home

- User Guide

Cash and Banking Management

The cash management module analyzes cash flow from various transactions, while the bank management module gathers financial data in one place, making it easier to track and ensuring a smooth audit.

1. Banks - Cash

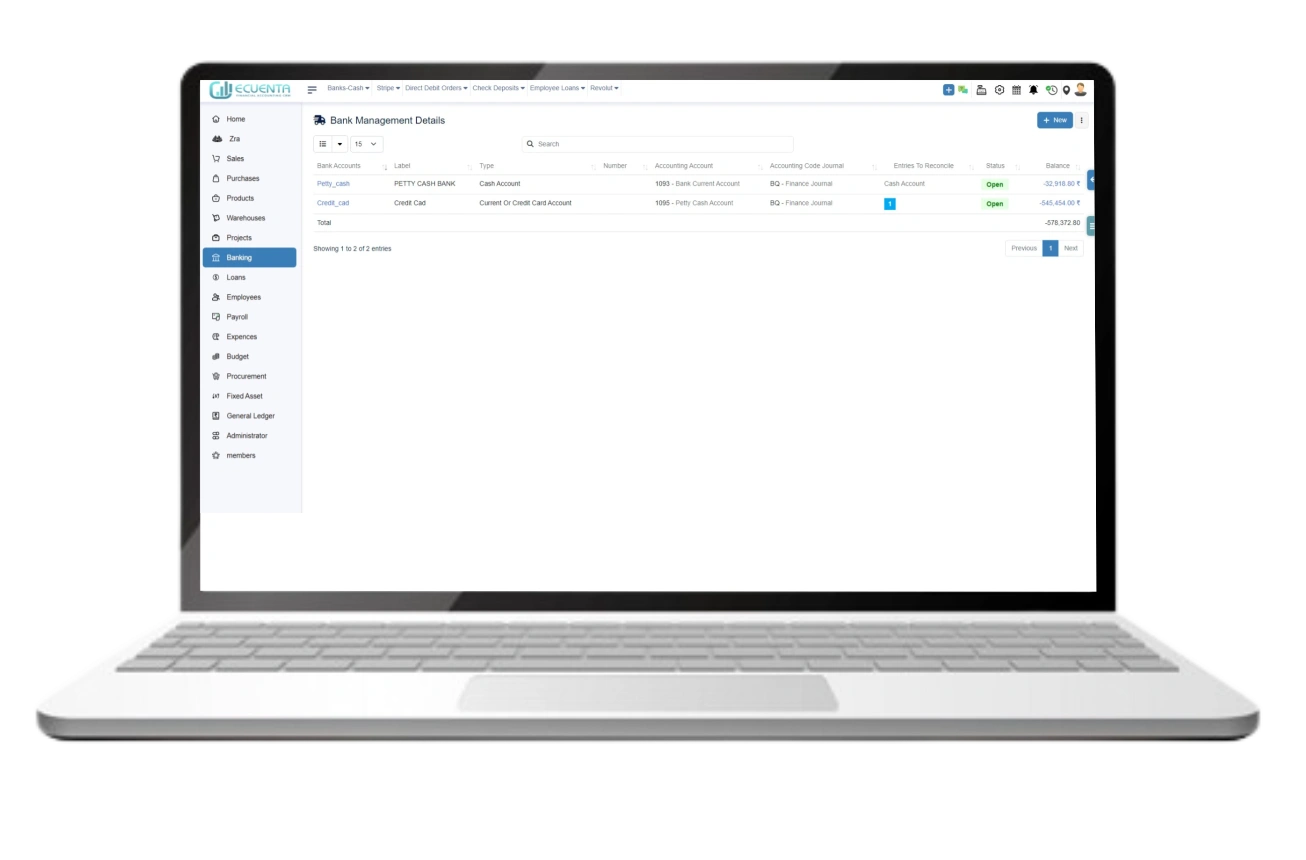

1.1 Bank Accounts

Bank accounts allow you to view the list of bank accounts you have added to the system for your business processes.

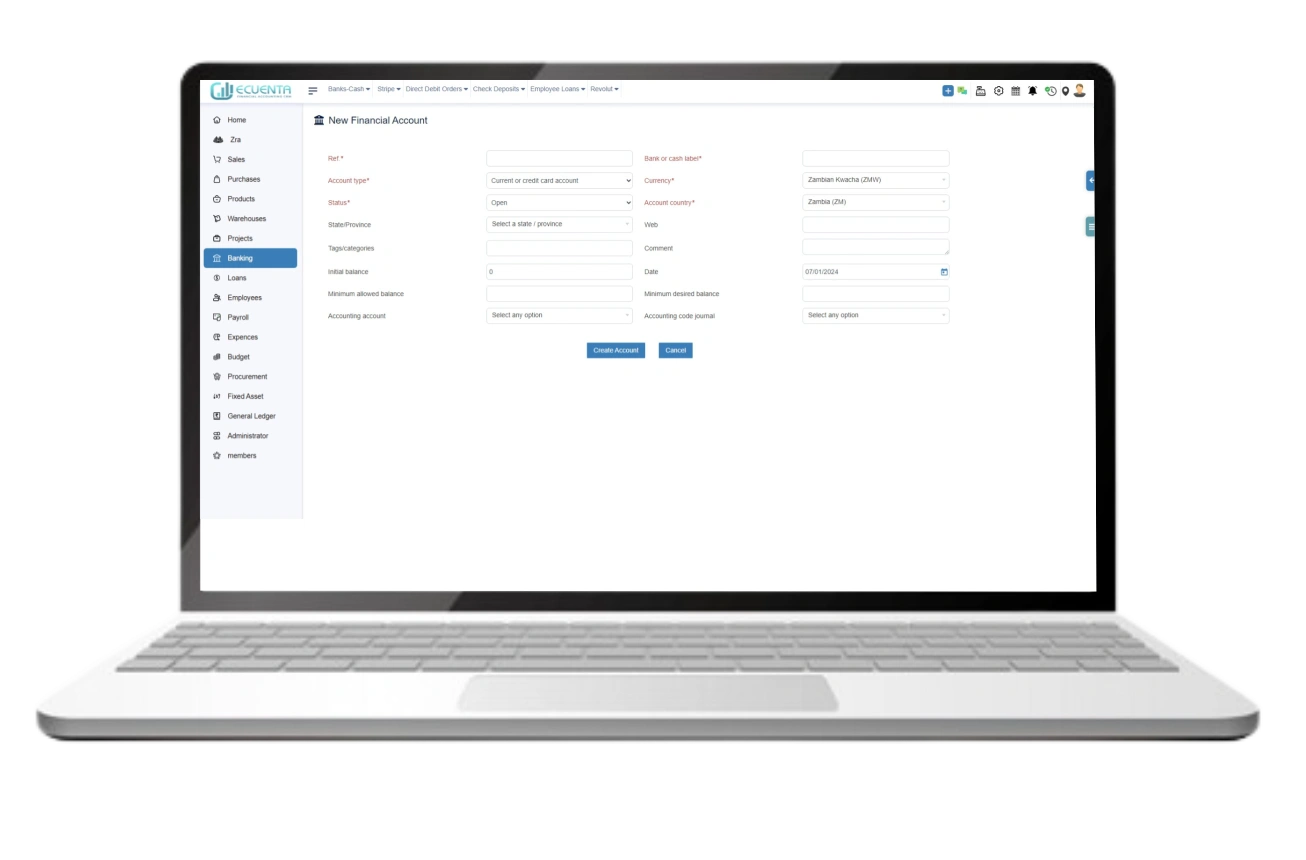

1.2 New Financial Account

Adding a bank account requires filling out details regarding the bank account you are using for your business then click Create Account.

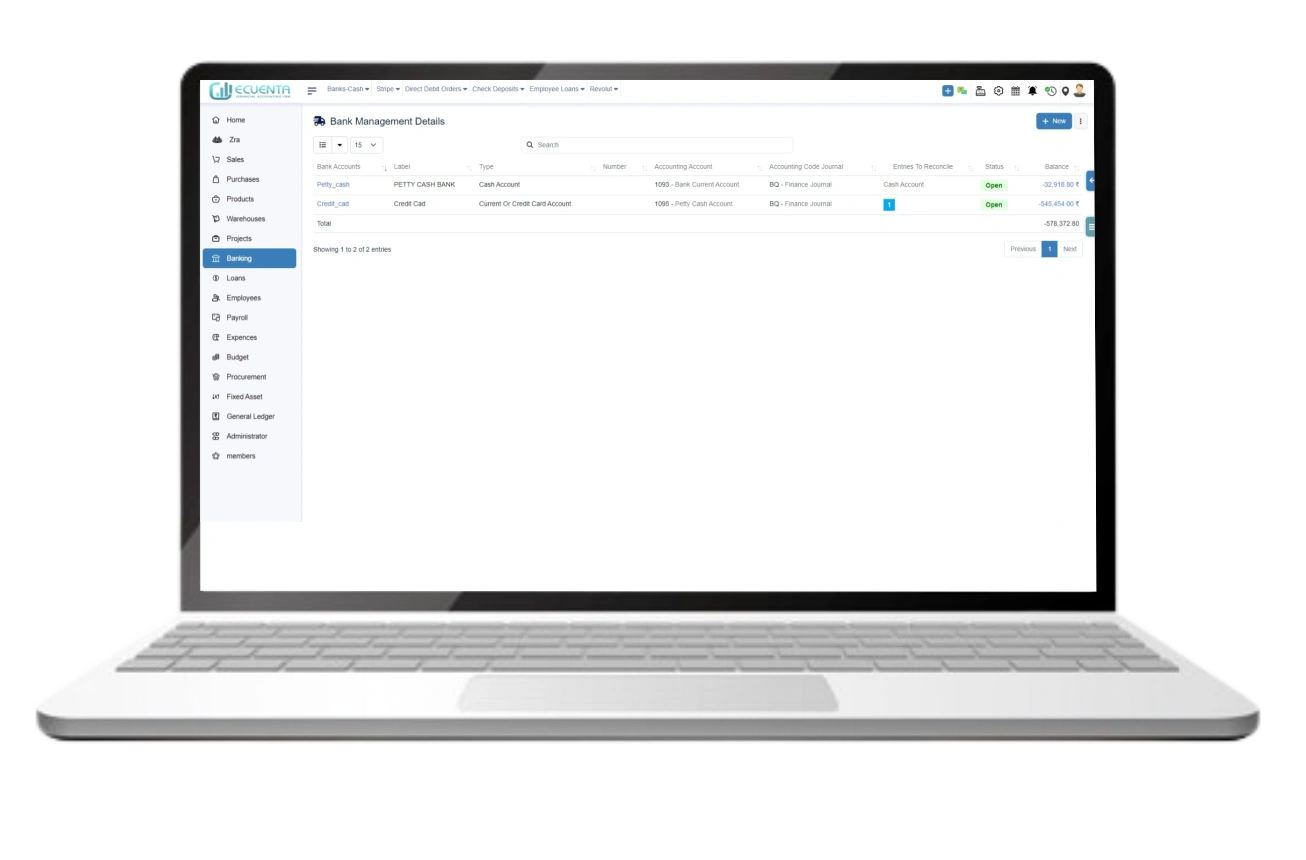

1.3 Bank List

It shows you the list of bank accounts you are using for your business processes which were added to the system by you.

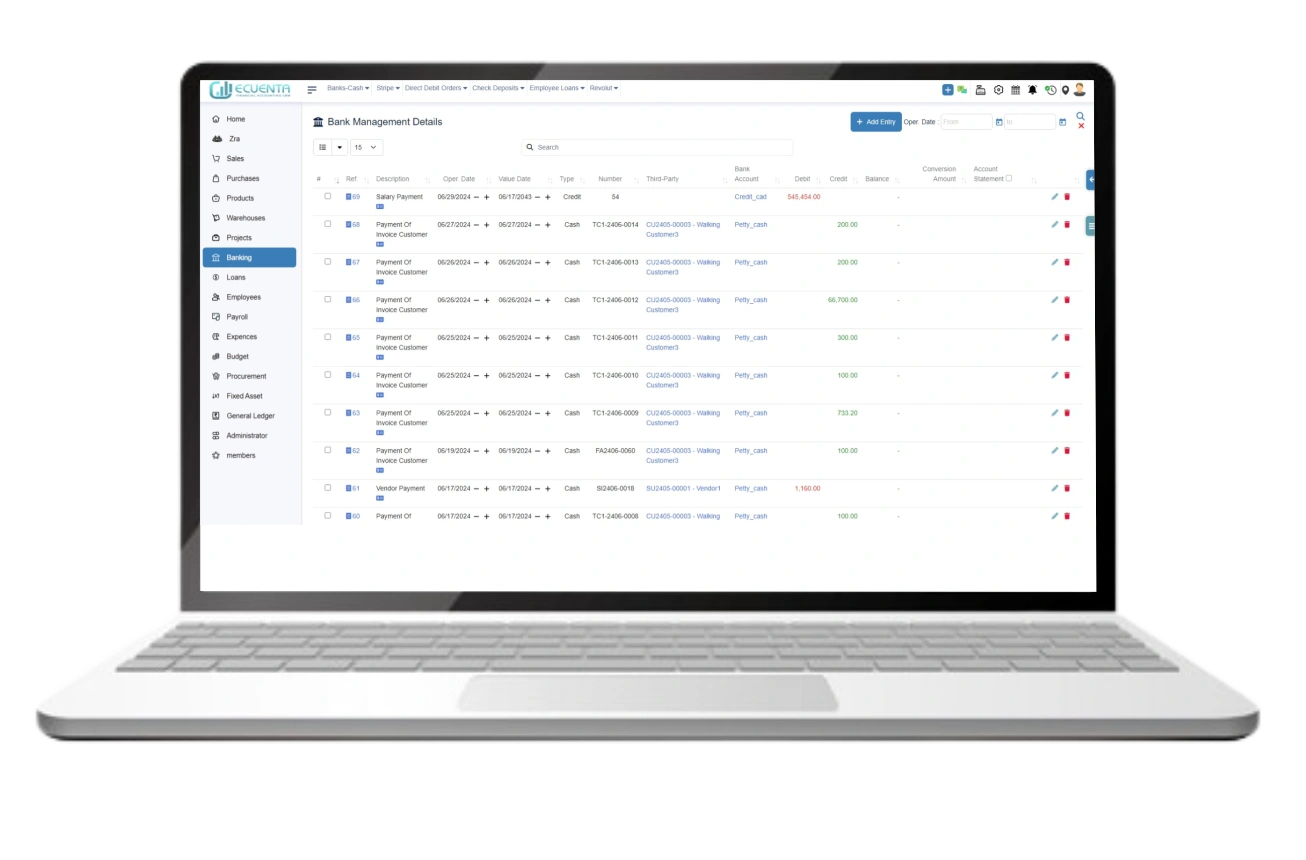

1.4 List Entries

It allows you to view a list of bank transactions you have made with your multiple or single bank accounts. It works according to the invoice data you have entered into the system.

You modify and delete the transaction by choosing .

To add a transaction to the list, click Add entryAdd Entry.

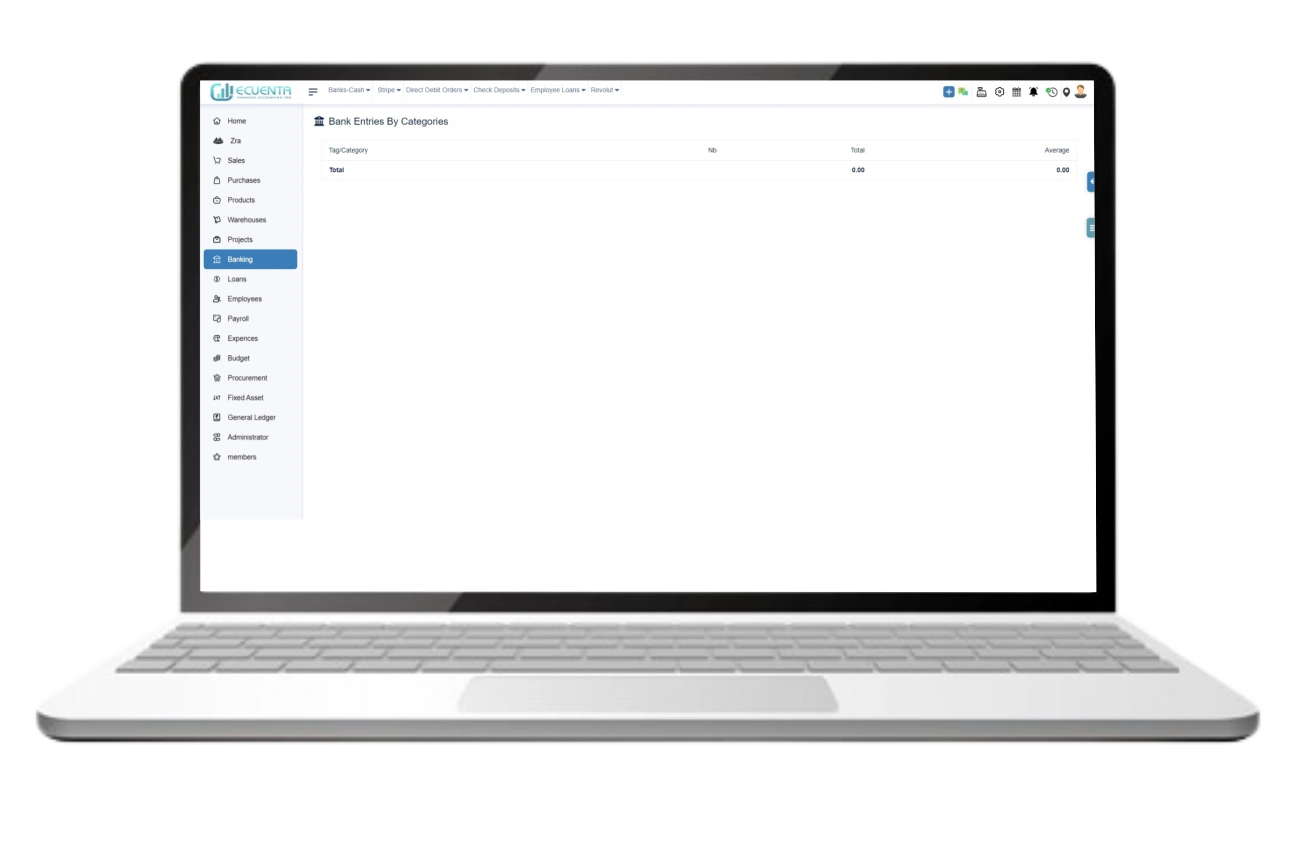

1.5 List Entries/Tag/Categories

Clicking List entries/tags allows you to view the list of categories you have done for your bank account for easier identification.

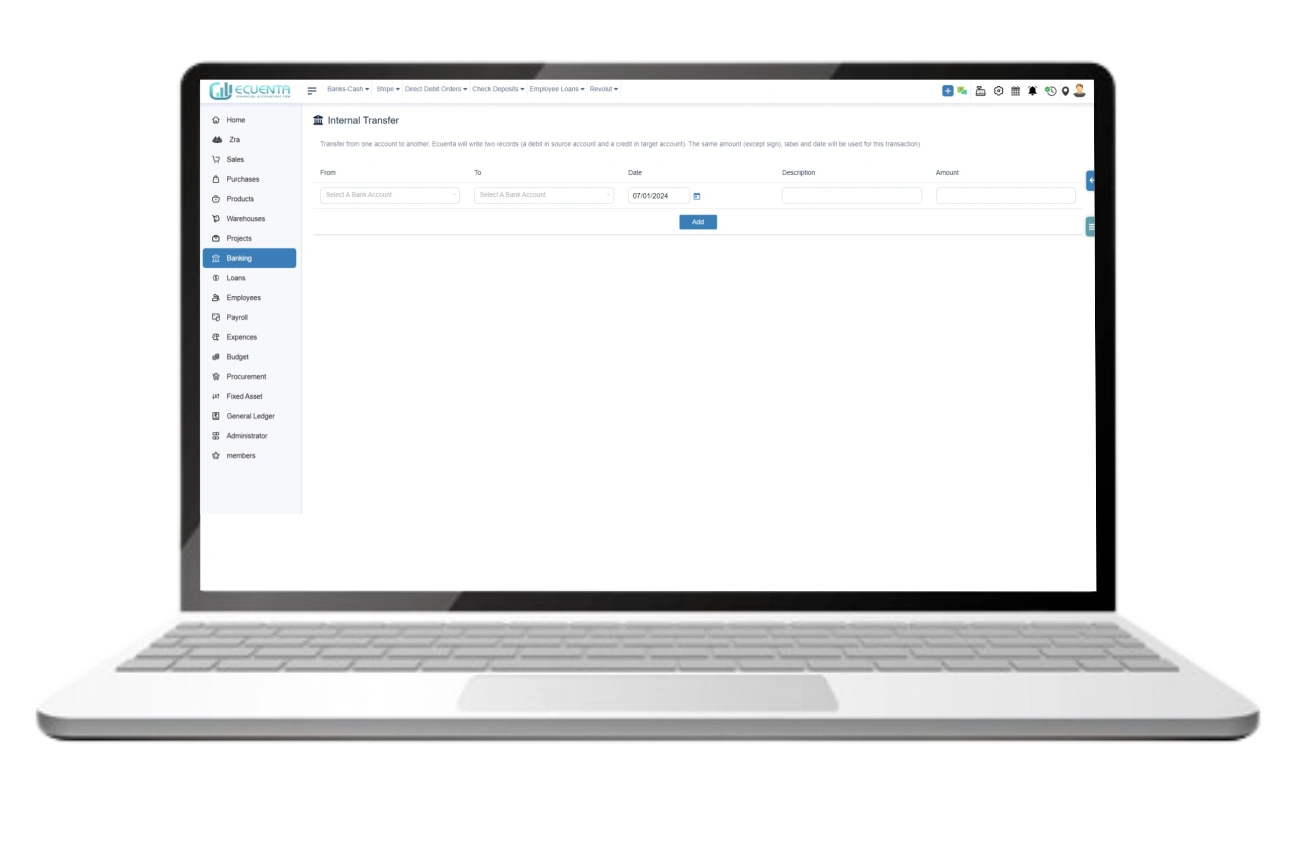

1.6 Internal Transfer

Clicking Internal transfer allows you to view transactions you've already made between your accounts

When you transfer funds from one account to another, Ecuenta will generate two records: a debit in the source account and a credit in the target account. The transaction will use the same amount, label, and date.

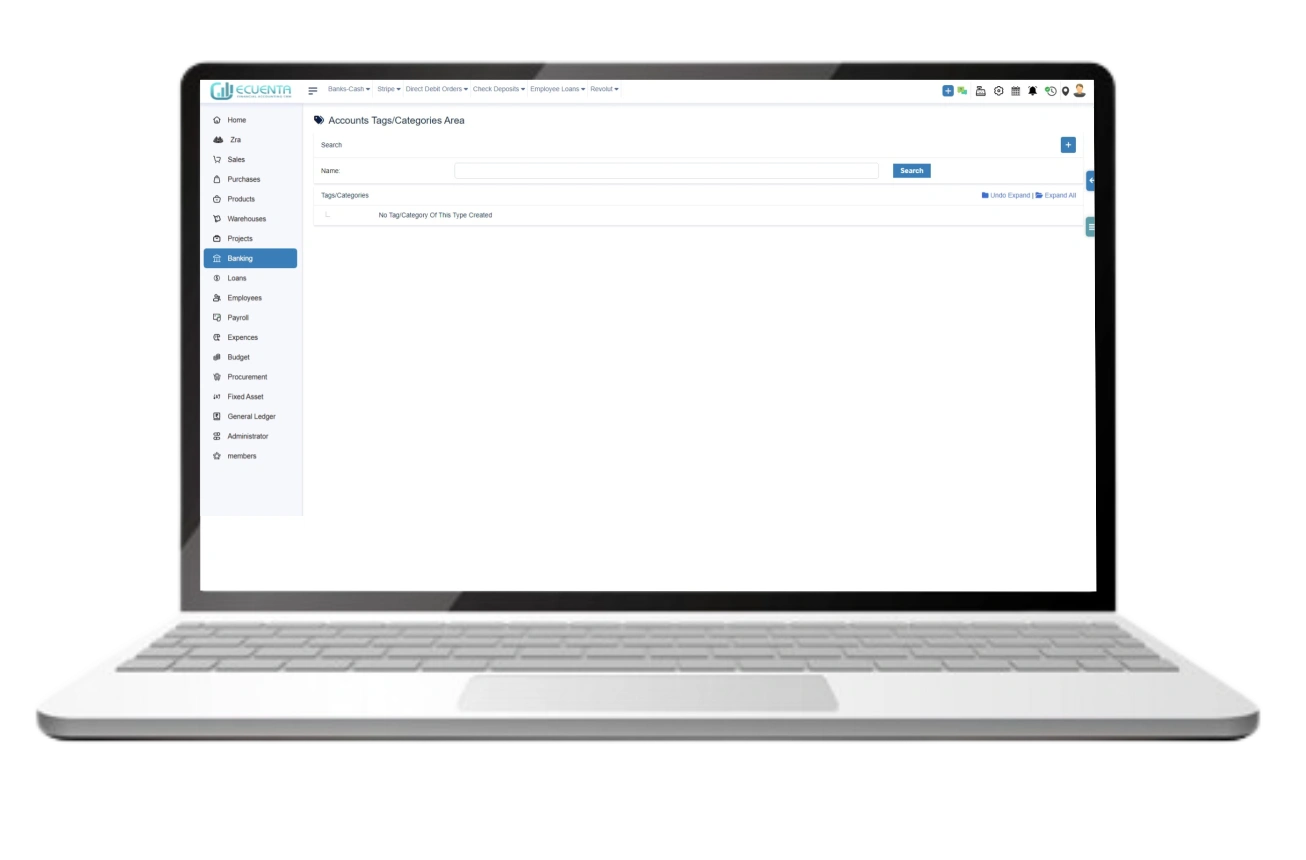

1.7 Tags and categories

Clicking on tags and categories allows you to view a categorized list of bank accounts. You can add tags and categories to your bank accounts for easier access.

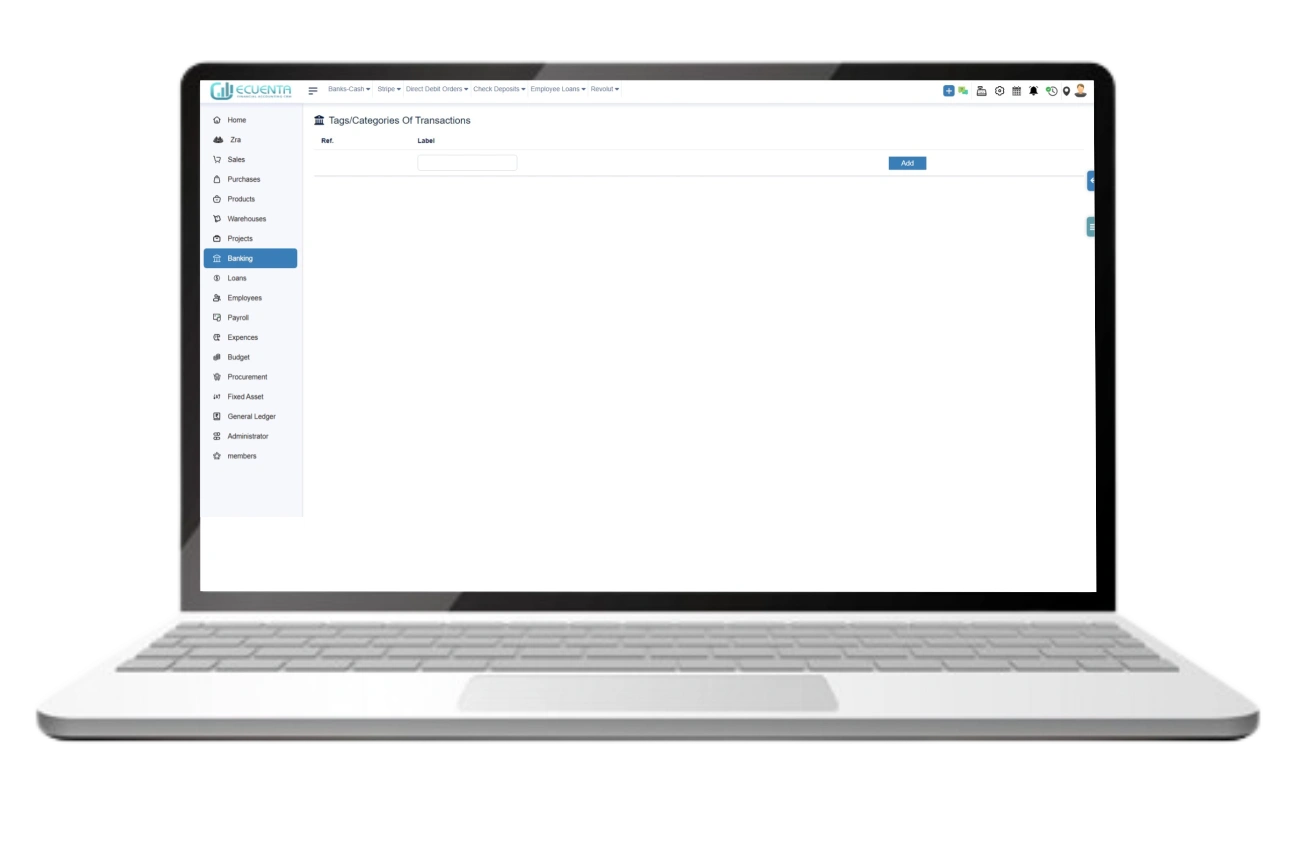

1.8 Tags/Categories of Transactions

Clicking tags/categories of transactions allows you can add tags and categories to transactions for easier access.

2. Stirpe

It enables you to transfer funds from a customer's bank account to your business account through a credit card, debit card, or alternative payment method transaction.

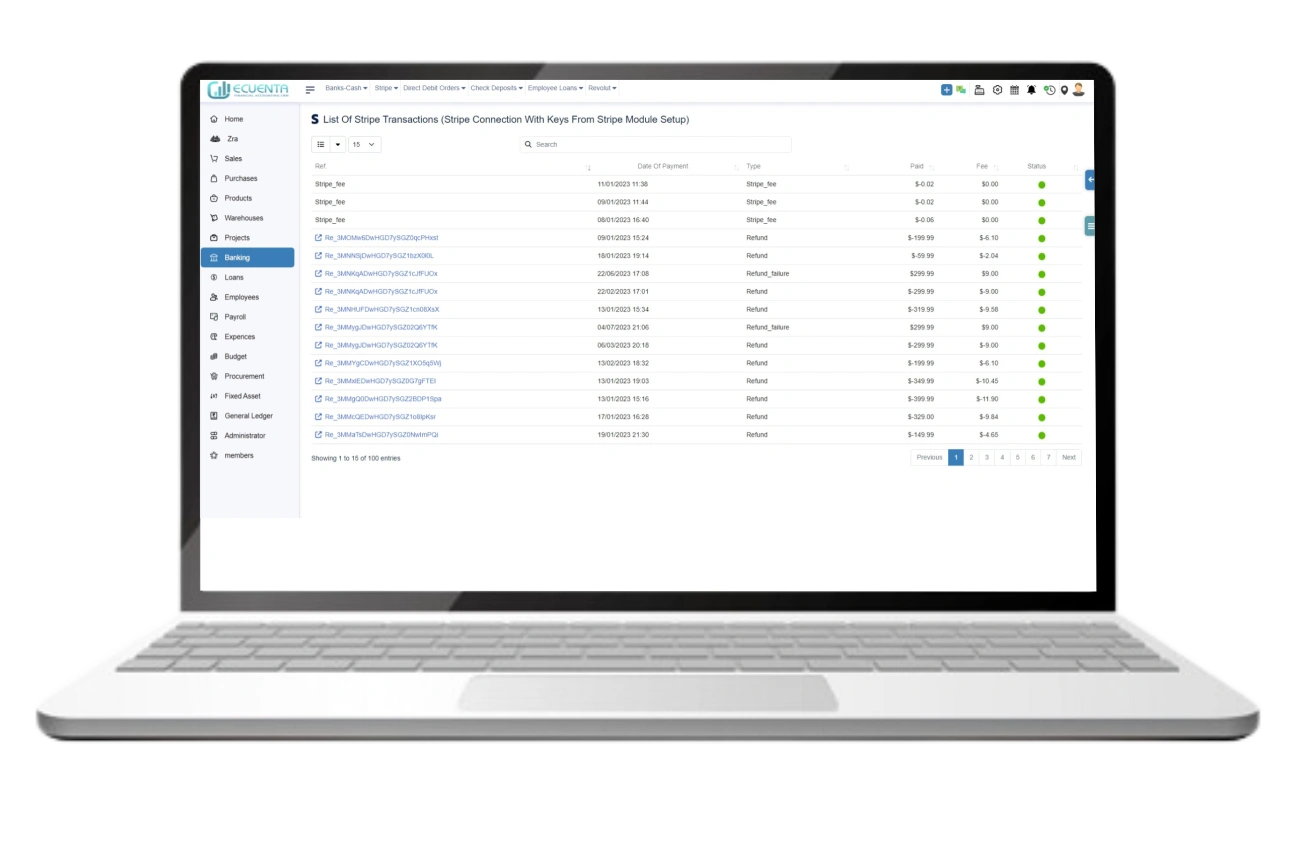

2.1 List of Stripe Transactions

By clicking List of Stripe Transactions, you can view a list of all the transactions, such as the fees Stripe has charged, refunds if any, status, and the amount transferred to your bank account by Stripe.

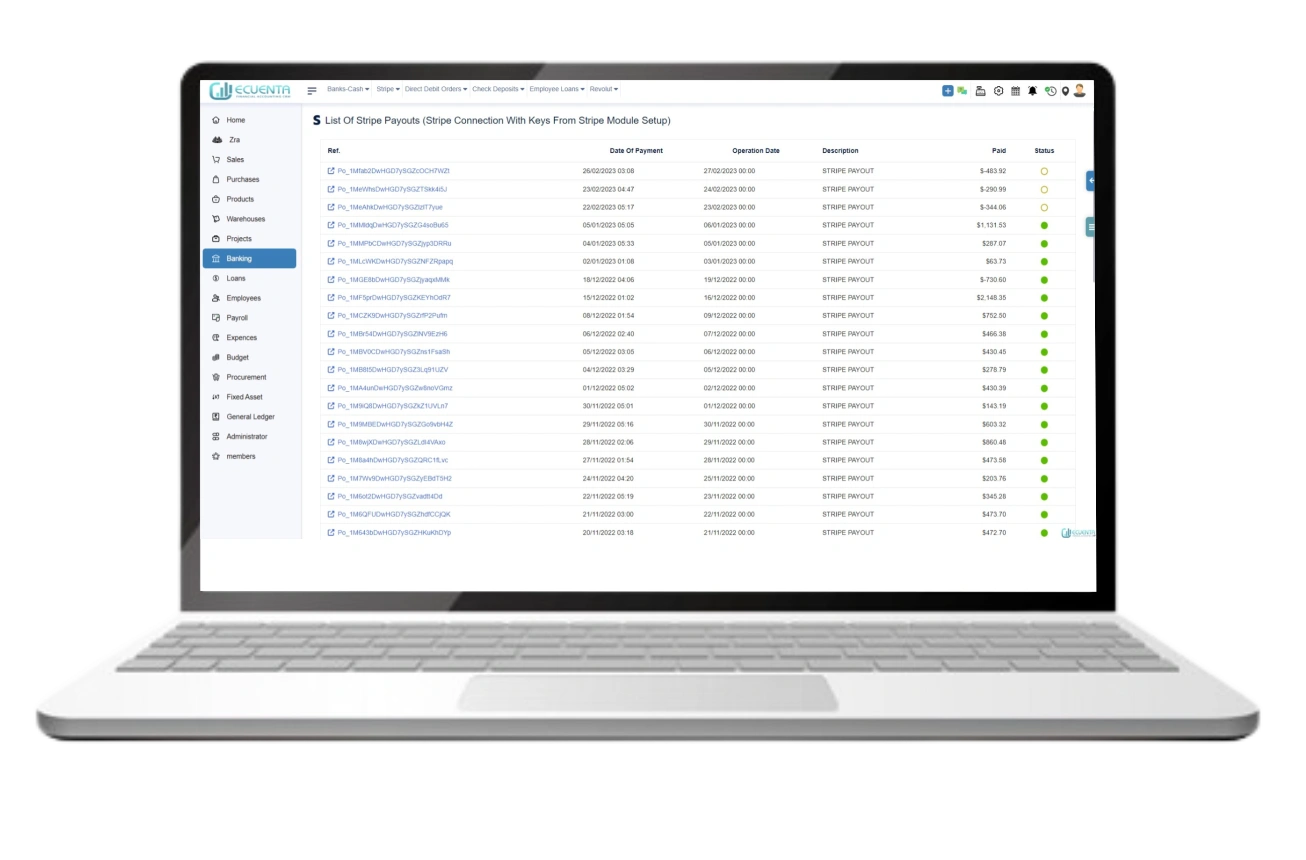

2.2 List Of Stripe Payouts

Here you will see a list of all your payouts, including the information on the Date of Payment, Operation date, the amount of payment, and the status of the payment.

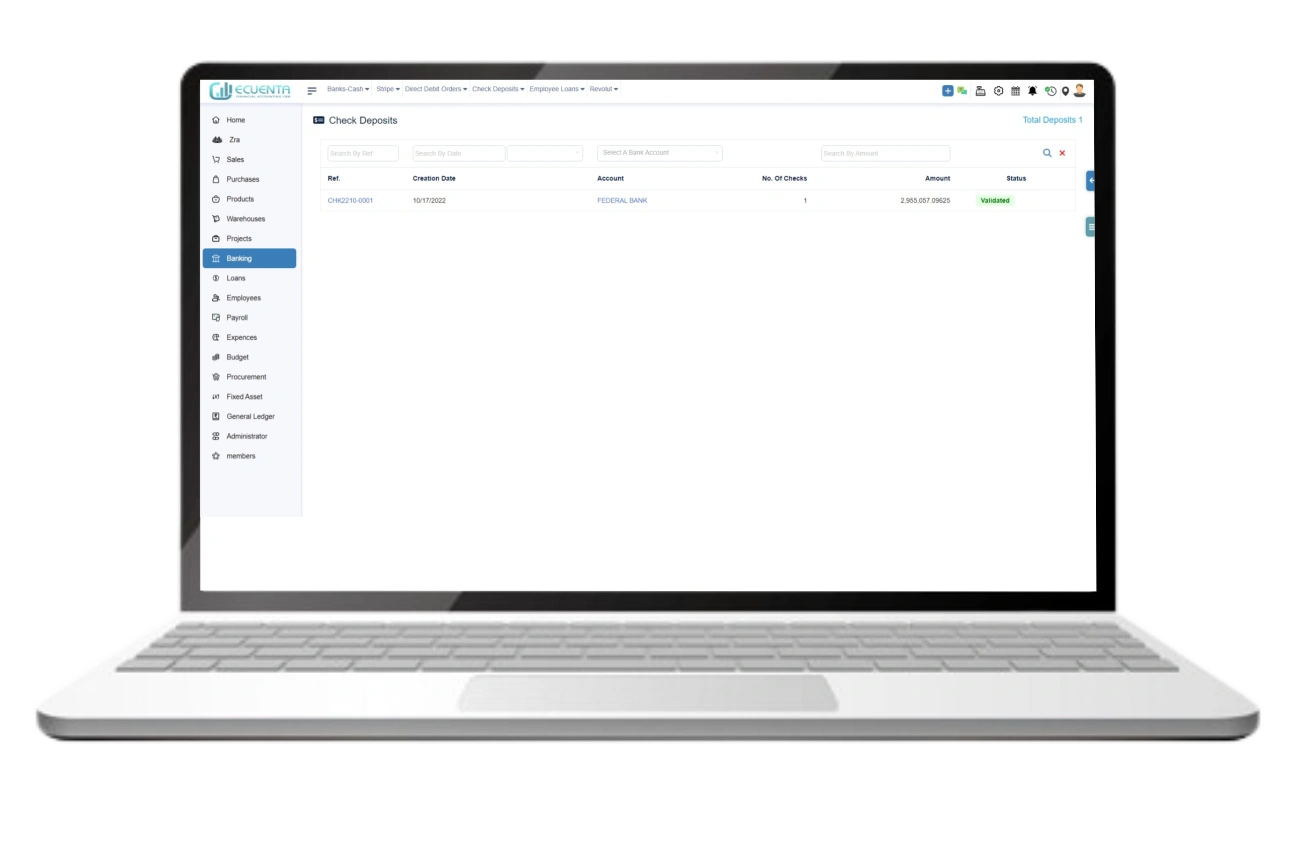

3. Check Deposit

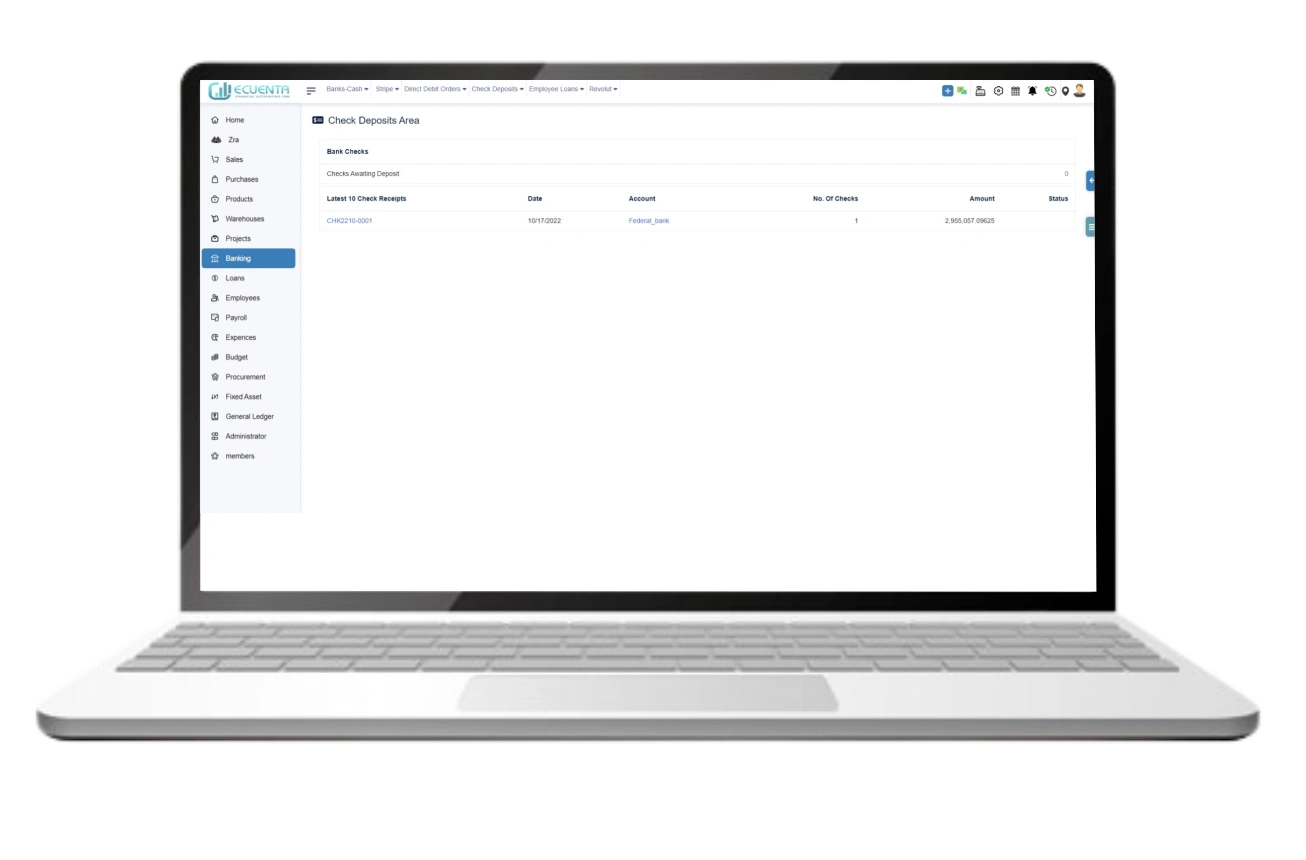

This feature allows you to view all the details about check deposits and check transactions.

3.1 Check Deposits Area

Clicking on the check deposits area provides you with a detailed overview of the check deposits and transactions made by your company.

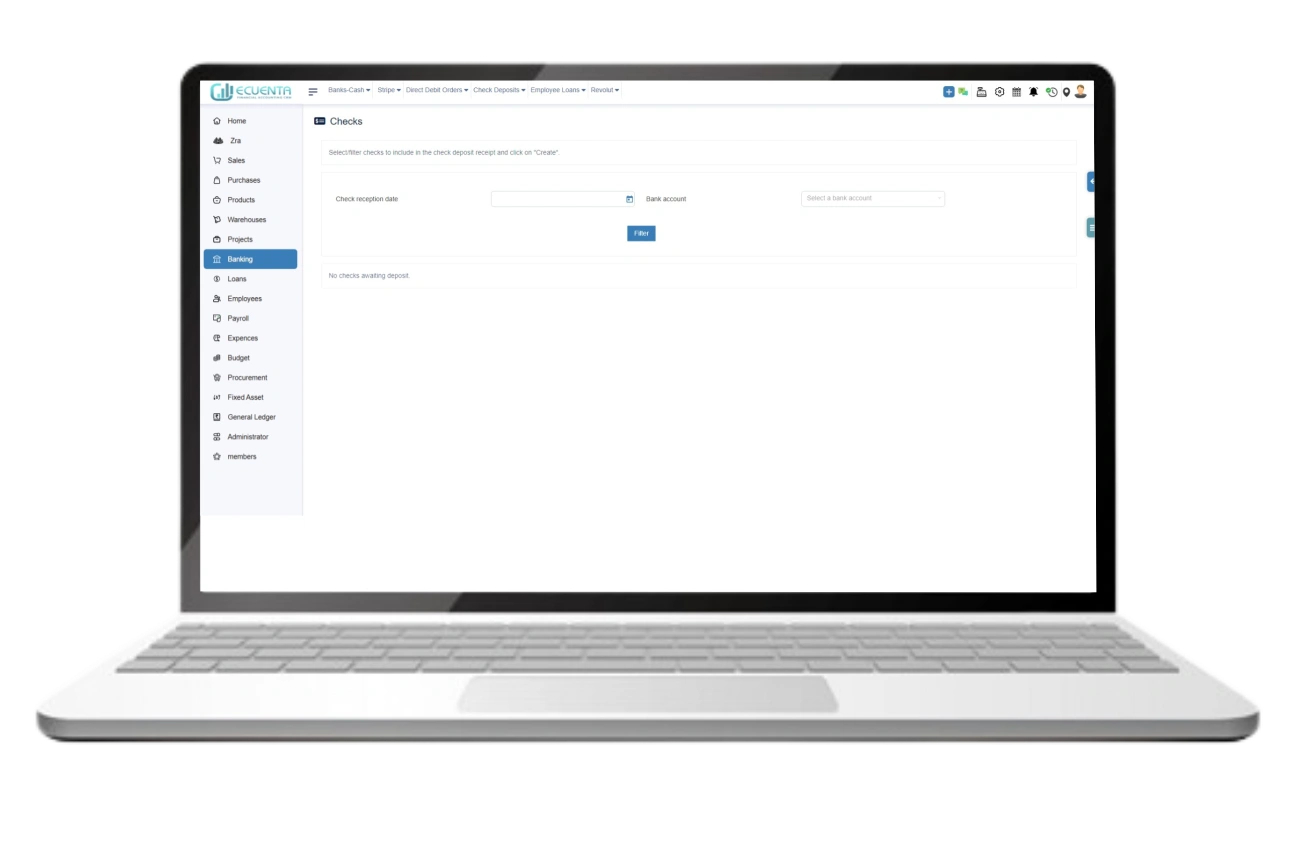

3.2 New Deposit

To create a check deposit receipt, please choose the checks you wish to include or filter them as needed. Once you have made your selections, click on the "Create" button to generate the receipt.

3.3 Deposit List

By Clicking, it displays a comprehensive list of your check deposits that have been added to the system.

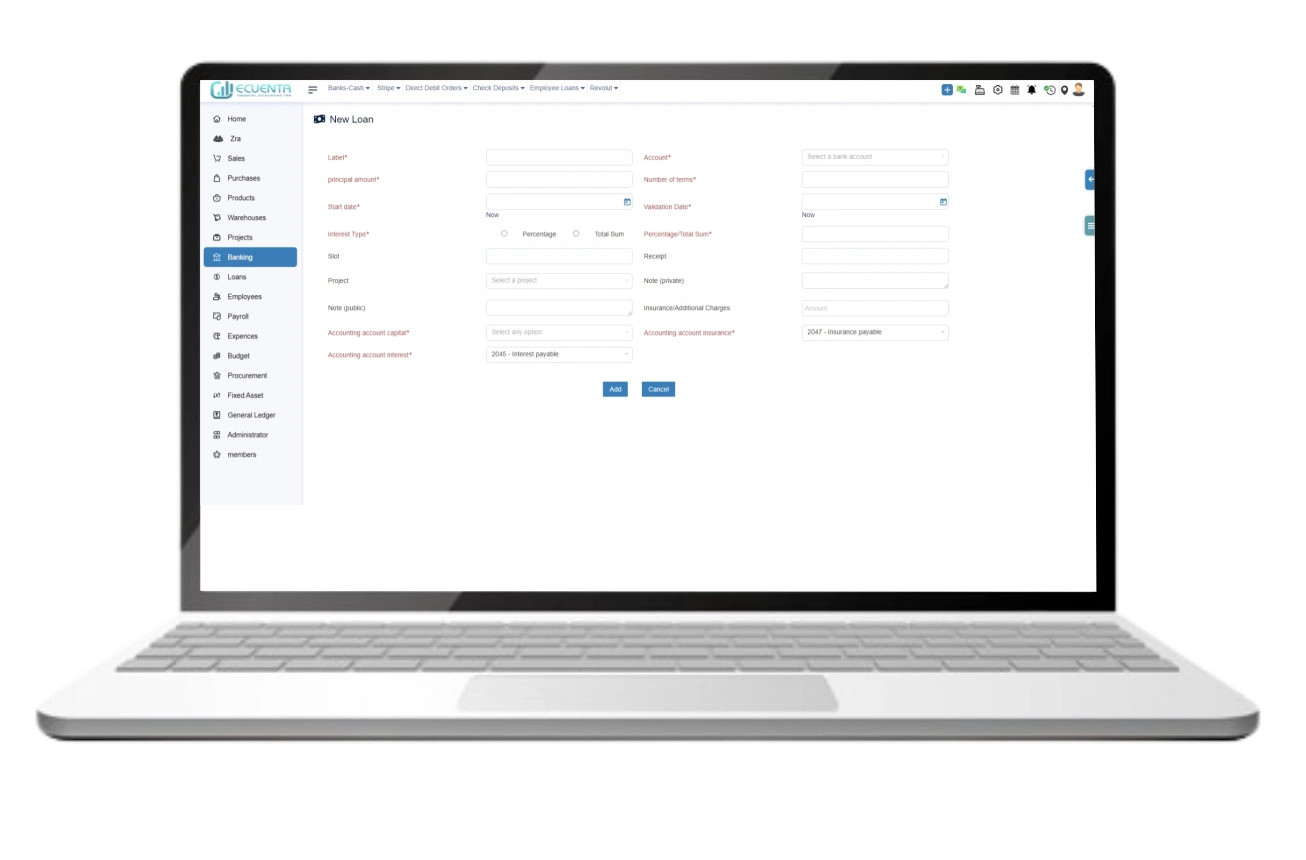

4. Employee Loans

It helps you manage all the loans that you’ve provided to your employees.

4.1 New Loan

You can add a new loan by clicking on New Loans. Fill out the form with the required details and click Add.

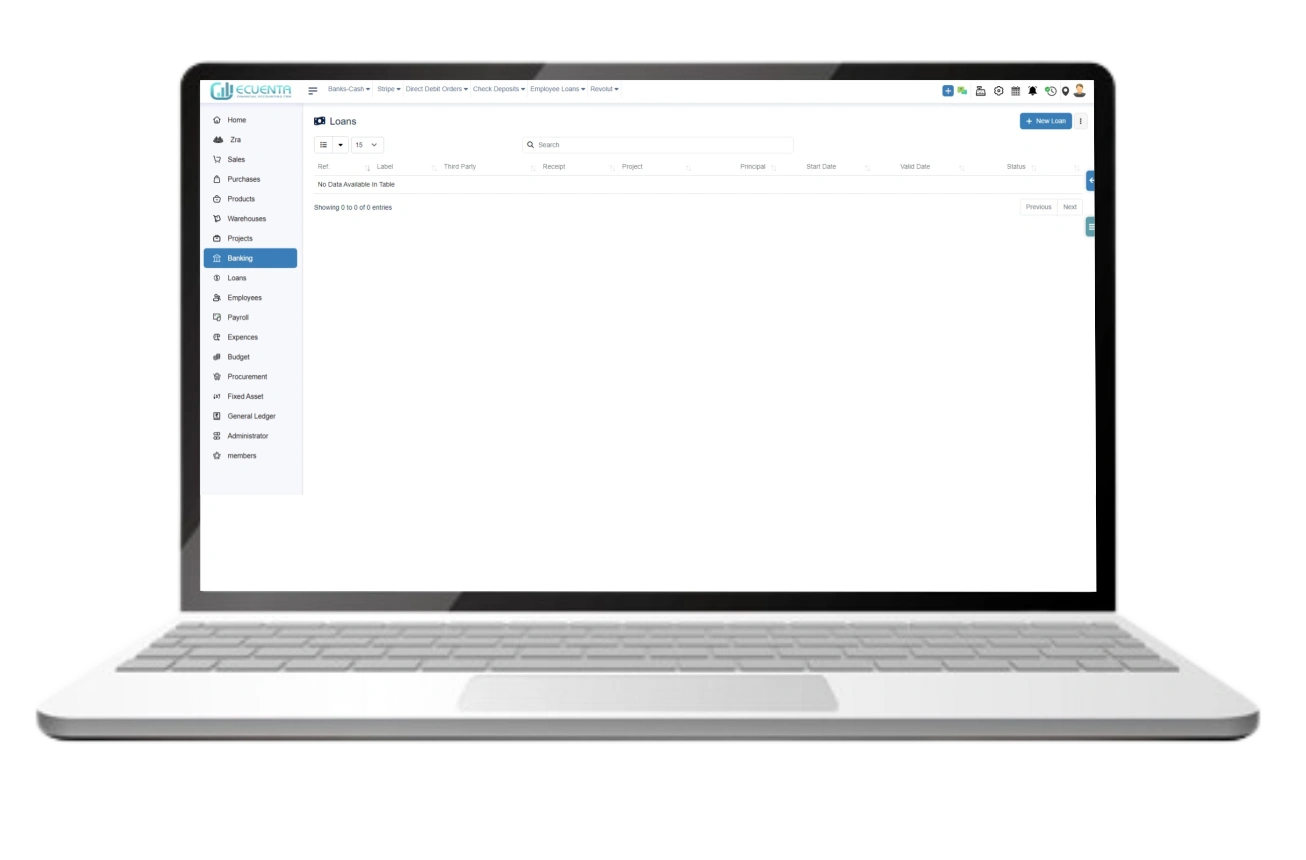

4.2 Loan List

By clicking Loan List, the list of all the loan details you have added will appear on the page.

-

Ecuenta is the first ZRA-certified and ZRA-integrated accounting software in Zambia. Our comprehensive service offers streamlined accounting solutions tailored for businesses operating across India, Zambia, UK and the USA.

Quick Links

Main Links

Support

- 9b Ngwezi road, Roma, Lusaka, Zambia

- info@ecuenta.online

- +260-764 864 419