Streamline Your Payroll: How HR Payroll Software Simplifies Payroll Management

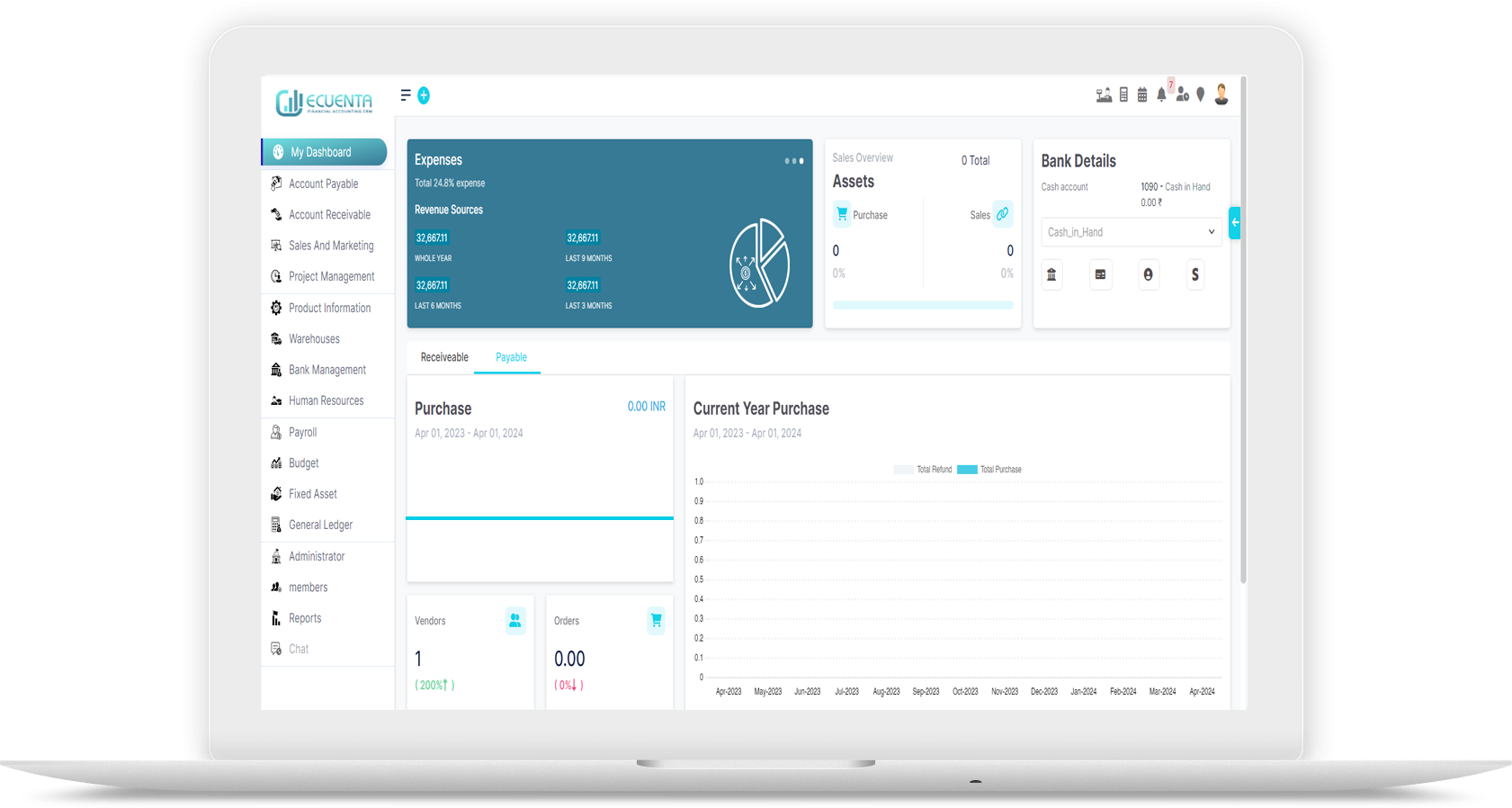

A cloud-based application called Payroll System combines, controls, and automates the payroll process within an organisation. Its duties include managing compliance, processing payroll, paying employee salaries, producing payslips, preserving the database's security and integrity, and more.

Consider yourself employed by a company where you determine your wage each month. When your superior has accepted it, he or she sends it to another person for approval before you are officially paid. Yeah… Sure, but who does that? Which business would do that? Not that I am aware of! This is because all reputable businesses have a well-organized payroll software in place.

"We don't just build websites, we build websites that SELLS"

― Christopher Dayagdag

HR process streamlining through payroll system management

Payroll processing is only one aspect of payroll system management. Additionally, it effortlessly connects with your HR procedures, streamlining your entire HR business. You may manage personnel data, track attendance, and keep track of accrued leave by using a central database. You may manage employee data more quickly and efficiently without the use of separate HR software or spreadsheets thanks to payroll solutions.

A payroll system can also automate the hiring and firing of staff members. It makes it simple to set up payroll information, gather relevant data, and add new employees. The system manages final payments, tax forms, and other relevant documentation to enable a smooth transition when an employee leaves the organisation. You may streamline administrative procedures and increase overall labour management efficiency by combining HR and payroll systems.

Digitise your information and data

Sorting through notes, paper checks, and time sheets can be done more quickly and with less effort if payroll data is digitalized and physical records are reduced or eliminated. Additionally, it helps speed up processes like producing reports, paying personnel, and providing them with important documents like tax forms. Digital data and information management will reduce inefficiencies and make accurate record-keeping simpler. Payroll teams may minimise disruption to ongoing operations and pay their employees accurately and on time from a remote location by digitising data and information in cloud software.

Key benefits of payroll software

- Payroll Processing

- Attendance Tracking

- Simplified Administrative Task

- Recruitment

- On boarding

- ZRA-Tax Filing

- Reporting

- Payroll Processing

- Attendance Tracking

- Simplified Administrative Task

- On boarding

- ZRA-Tax Filing

- Reporting

- Payroll Hold-Ups

- Paperwork backlogs

- Regulatory Issues

- Cost overruns

- Costly Errors

- Simplifies payroll processes and bookkeeping.

- Provides thorough reports on a variety of topics, including personnel, departments, pay structures, etc.

- Helps with correct income deductions

- Simple and sophisticated calculations are made available.

- Processing of flexible payroll

- Timely, error-free paycheck payments

- Payroll facilitation automatically

- Attendance control

- Automatic payment processing for salaries

- Enhanced Loyalty

- Detailed Insights

- Reporting Streamlining

- Improved Security

- Enhanced Loyalty

- Detailed Insights

- Reporting Streamlining

- Improved Security

Payroll processing automation is one of this software's main features. HR staff members no longer need to manually compile timesheets and calculate weekly totals, for instance. Your team can concentrate on other job responsibilities because the system handles these activities. But if something falls through the virtual cracks, the HR and finance departments can still manually input data or change totals.

It links the payroll human resources system with the biometric time and attendance device, maintains accurate attendance records, and makes payroll computations easier. It keeps track of everything, including sign-in and sign-out, early departure and late arrival, overtime and leave records.

Every HR procedure now feels at ease using cloud applications, whether it be for hiring, performing, orienting, or meeting deadlines. Payroll and HR departments have undergone a major transformation for the better thanks to HR payroll software.

The learning and development aspect of onboarding isn't handled by the majority of HR software. However, payroll solutions might assist you in minimising the associated paperwork.

Simplifying ZRA-tax filing is one of the key reasons businesses invest in HR and payroll solutions. While some solutions include ZRA-tax filing functions, others only aid in record keeping and payroll deduction.

Using basic payroll information that is properly coupled with a time & attendance device/biometric system that accurately calculates worked hours and data, the software generates reports on time. The report provides a thorough overview of how the staff members are performing and a detailed appraisal of their effectiveness and worth to the business.

Which challenges might HR payroll software assist you in overcoming?

Several ways that HR payroll software can benefit your company

How does payroll software support businesses?

Companies can pay their employees on schedule with the use of a payroll system. Additionally, since the system determines the payout based on the monthly inputs, there is no margin for mistakes. Furthermore, timely payment of wages increases employees' loyalty and trust in their employer.

A specialised payroll system can also offer comprehensive analysis capabilities that can offer insightful information about many elements of employee payroll.

With interactive dashboards, payroll software offers the possibility of real-time insights. It also offers numerous options for creating and disseminating interactive reports.

Payroll software is the best option for a business because it deals with cash and needs top-notch security. Additionally, it guarantees that only the appropriate person has access to the payroll data, thereby excluding everyone else.

What Compliance Benefits Can Payroll Software Provide?

Using professional payroll software makes it easier to handle the legal requirements for company payroll. It streamlines tax calculations and other compliances to assist you avoid fines that aren't essential. The compliance standards are also dynamically adjusted based on the firm location, ensuring that you always remain compliant even when opening a new branch in a different region.

ZRA-taxes and related calculations are frequently outsourced by businesses, adding to their overhead costs. With the use of specialised payroll software, which can carry out these duties automatically, these costs can be reduced. Additionally, payroll software aids in maintaining accuracy and provides a general picture of the business payroll. The automated computations also aid in preventing any numerical errors.

Conclusion:

Numerous advantages of payroll system administration might transform your company. A payroll system streamlines your payroll process, allowing you to concentrate on critical company operations while also realising cost savings and efficiency improvements and assuring compliance and accuracy. A payroll system can serve as a central centre for handling employee data and payroll-related duties by optimising HR operations, boosting data security, and integrating with other business systems. The key to reaping the advantages of your payroll system is selecting the best one for your company and successfully deploying and optimising its use. The future of payroll system administration provides even greater promise for organisations with ongoing developments and technological advancements.